A mutual fund is one of the various types of investments available in India. Whenever you are investing in a mutual fund, there is a key metric that you should know about and that is Net Asset Value, commonly known as NAV in Mutual Funds.

Many people are confused about what is the actual meaning of NAV, how is it important for us to know about NAV, and many more. So, in this guide, I will be clearing all your questions, and all your doubts regarding NAV so that you can invest in any mutual funds with proper knowledge. So read till the end!

Definition of NAV

NAV or Net Asset Value is the value per unit of a mutual fund. Be it an Equity Mutual Fund, Debt Mutual Fund, ELSS, or any mutual fund for that matter. It gives the overall value of the fund’s portfolio at any given time. So, as an investor, whenever you buy or sell a mutual fund, you will be buying or selling it at the NAV price.

You can imagine it like this. If you are investing in shares of any company, you will be investing on the share price of that particular company. Similarly, in mutual funds, you will be investing on NAV price.

Importance of NAV in Mutual Funds

The NAV in mutual funds is like the heartbeat of your investment. As discussed earlier, it tells you the current value of each unit in your fund. Here’s why it’s super important for you to track the NAV of your portfolio:

- NAV guides your transactions as it helps you to know the price of each unit of that particular mutual fund.

- It’s a quick way to see how well your fund is doing.

- You can track your mutual fund based on how NAV changes over time.

Components of NAV in Mutual Funds

NAV has two main components to track.

1. Assets

Assets are all the things the fund owns that add in value over time. Stocks, bonds, cash, etc. are all assets in NAV.

2. Liabilities

Liabilities are all the things the fund owes or the expenses they may have. The management fees, redemption claims, debts, etc. are all liabilities in NAV.

How NAV is Calculated?

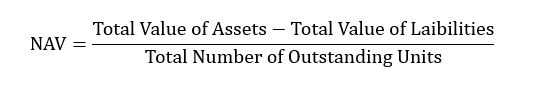

Now that you know about the assets and liabilities of a mutual fund, let’s calculate its NAV with a basic mathematical formula:

Let’s take an example.

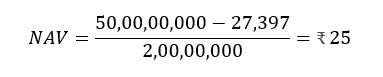

Consider an Equity Mutual Fund having a total asset of 50 crores.

Liabilities can be different for different funds. But for understanding, let’s take only management fees of 2% as the liability of that fund. So, the management fee per day is:

Finally, let’s assume the mutual fund manager launches 2 crore units of that fund. And you can buy multiple units from it.

So, from the above formula:

Therefore, the per unit value of this mutual fund is ₹ 25.

So, if you invest ₹ 1000 you will get 40 units of this fund.

This is how daily NAV in Mutual Funds is calculated.

Factors Influencing NAV in Mutual Funds

As the share price of the stocks goes up and down every moment, similarly, NAV price is also influenced by a couple of factors.

- As the share prices of the stocks in the mutual fund change, so does the NAV.

- The fund expenses like operating costs, and management fees too, influence the price of NAV in mutual funds.

- When a fund shares profit with you in the form of dividends, NAV gets a cut too. You get a bonus, but NAV loses its value.

Common Misconceptions about NAV

There are some common misconceptions about NAV among retail investors. Let’s look into it and clear the doubts.

1. Low NAV means Cheap Funds:

People might think a low NAV means the fund is cheap and we are getting a better deal. But you have to understand that NAV is just a reference point. It doesn’t determine the fund’s value. Even a fund with a low NAV can have high-quality investments.

2. High NAV Means Better Performance:

Some might even think that high NAV means the fund is performing better than the rest. But NAV is just the price per unit of the mutual fund. A high or low NAV value does not tell you if the fund is performing well or not. You have to track the growth of the NAV over time. That is what matters.

3. Impact of Fund Size on NAV:

Some may think the bigger the fund size of the mutual fund, the higher the NAV and thus higher returns. Actually, NAV is not influenced by the fund size. As I have discussed earlier, NAV is determined by the underlying assets and liabilities of the fund. Therefore, even a small fund can have a high NAV if its investment performs well.

4. Comparing NAVs Across Different Fund Types:

Different types of funds have different risk profiles and different objectives. Equity mutual funds have a higher risk than that of debt mutual funds. They are completely different. Comparing NAVs alone doesn’t give you the complete picture. You have to consider the fund’s investment objectives and risk factors.

Understanding these misconceptions helps you to make more informed decisions while investing in mutual funds. It’s important that you look beyond NAV and consider the fund’s strategy, goals, past performance, and the fund manager for a clearer investment picture. In some other article, I will help you how you can decide which mutual fund you should invest in.

Tools for Monitoring NAV in Mutual Funds

The only way you can benefit from NAV is by monitoring it over the period. Just by determining whether the NAV is high or low cannot tell you the exact report of the mutual fund. There are various tools available to help you monitor the NAV in your preferred mutual fund:

- Mutual Fund Website: Most mutual fund companies have their own official websites that provide you with real-time NAV updates.

- Mobile Apps: Many mutual fund companies even have their own mobile apps to help retail investors.

- Investment Platforms: There are a number of online investment platforms and brokerage websites where you can compare and invest in various mutual funds. They provide you with dedicated tools for tracking NAV.

Conclusion

Understanding Net Asset Value or NAV in mutual funds is not just about numbers. It is a way by which you can make informed decisions while investing in mutual funds. NAV helps in reflecting the fund’s performance over the period and guides your transactions. While common misconceptions can hamper your decisions, this blog has cleared them and has shed light on the real factors that influence NAV.

You can now recognize that a fund’s worth is not determined just by a high or low NAV but by consistent growth over time. And to monitor this growth and to monitor the NAV in mutual funds you can get help from various tools like mutual fund websites, mobile apps, and online investment platforms.

So, let Net Asset Value or NAV be a guide in your investment journey into mutual funds. Always make informed decisions and do not listen to any tips.

Let me know in the comment section below if you have any more questions. Do share the blog with anyone who needs to read this!